For our fourth series of events on the future of fintech and financial services

rest

Embedded Finance: A bubble or a paradigm shift?

We rounded off 2021 by holding our third virtual event in our ‘Money 2030’ series on the future of fintech

Embedded Finance: How will increased regulation affect the pace of adoption

We recently held the third virtual event in our ‘Money 2030’ series on the future of fintech

Embedded Finance: What is propelling the growth of this sector?

On the 8th of December, we held our third Money 2030 event.

Money 2030 Virtual roundtable on 8th December 2021: Embedded finance – a bubble or a paradigm shift?

For our third series of events on the future of fintech and financial services

Insights from Money 2030 – Consumers and Finance as a Service:

What is the impact of Finance as a Service on consumer expectations, and what does this mean for providers?

Insights from Money 2030 – Who are the winners and losers with the rise of Finance as a Service?

Last month, we held the second virtual event in our ‘Money 2030’ series on the future of fintech which featured expert panelists from across technology and financial services.

Insights from Money2030 – Why is Finance as a Service (FaaS) taking off now?

Our summary of our second event on the future of fintech, looking at “Finance as a Service”.

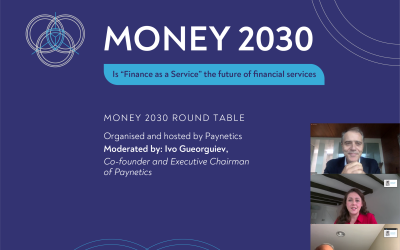

Money 2030 round table – 10th February – Is “Finance as a Service” the future of financial services?

In the second of our series of events on the future…

Paynetics becomes member of the Emerging Payments Association

Here at Paynetics, we are proud to announce that we have become a member of the Emerging Payments Association (EPA), a leading industry body for the payments sector.

Thoughts from our experts at our Money 2030 event – What the future of fintech looks like

Here’s a summary of our recent Money 2030 expert panel event, entitled “In the future, everyone’s a fintech”

Money2030 round table – 7th October – In the Future, Everyone’s a Fintech

The next ten years will see huge changes in the financial services sector as technology will create a platform for every company to offer fintech services to their clients. We’re already seeing retailers and ecommerce companies, telecommunications providers,...

Who will be cashing in on a cash-less society?

A cash-less society has been talked about…

Five predictions for the future of payments

The coronavirus pandemic may have completely upended…

How issuing complements acquiring

Benefits of combining issuing and acquiring…

In a race to become a cashless society

How can smartphones replace point of sale systems and drive digitalisation of payments?

What is software POS

The software POS is a revolutionary new technology which allows merchants to accept card

payments directly on their phone or devices without the need for any additional software.

Currently the existing software POS solutions work only with the Android OS.

Banks versus Fintechs

From distrust to love/hate – are fintechs and banks starting to get along?