Pure

BIN Sponsorship

Cards issuing without complexity

Offering Visa and

Mastercard, quicker

Through our BIN Sponsorship we can help you bring Visa and Mastercard payment cards to your business quickly and conveniently. Direct scheme membership can be costly, complex and time consuming. We empower you to manage your own programs, such as eWallet accounts and prepaid cards or debit cards, without the need for an individual e-money licence or direct scheme membership.

Speed

Shorten the time to market for your own payment cards or wallets

Efficency

Let us handle all the red tape, while you look after your customers

Full toolset

A full suite of payment services, all under one roof

How does

BIN Sponsorship work?

BIN sponsorship is the fastest and most convenient way to launch a payment card programme, significantly shortening the time to market. A scheme-assigned BIN (bank identification number) enables companies with an established client base and business model to deploy their own cards or wallets without having a direct membership in the card schemes.

Paynetics’ status as an e-money institution means that our partners can perform many of the operations of a financial institution directly through us. As Principal Members of both Mastercard and Visa, we assist such businesses to have their own eWallet and run their own card programs.

Paynetics makes things easier for merchants with a comprehensive suite of acquiring services, including merchant on-boarding, PCI DSS compliance, fraud prevention, dispute and risk management, tailored for each specific business model. It provides a fully PCI DSS compliant payment platform which is easily integrated into online shops and which gives them a one-stop solution for eCommerce, mCommerce, eWallet and industry specific alternative payment channels.

What is Paynetics’ role

as a BIN Sponsor?

We work closely with our partners to design and implement card programs that exactly match the needs of their clients.

Our role is to:

- provide access to the Visa and Mastercard networks

- ensure regulatory compliance with all existing payment regulations within the EU and UK

- submit and get approval of the card programs through the Visa and Mastercard network

- provide the necessary reporting to the card schemes

- establish and manage cardholder funding account. As an e-money institution, Paynetics holds all client funds in special accounts, which are segregated and safeguarded. This provides a higher level of security than holding funds in a regular bank account

- lead or coordinate the integration with the processor

- ensure clearing and settlement of funds

- manage risk and develop transaction and client monitoring guidelines

- ensure KYC of cardholders is in line with existing AML requirements

- perform program control and audit

Paynetics fulfils all of the above duties so that our partners are able to focus on what matters to them – their clients. This is how we empower our partners to provide superior customer service to their clients, time and time again.

Working with

multiple processors

We understand the complex nature of the relationship between program managers, BIN sponsors and processors. Program managers would usually have built deep integration with specific processors. From their side, processors would have developed multiple programme manager relationships. As both program managers and processors provide a route to market to deliver multiple programs, it is the BIN sponsor who acts as the glue that keeps the process together.

Whilst Paynetics needs to have a direct relationship with the processor, we empower our partner program managers to lead this three-party relationship.

We are processor-agnostic and can work with all accredited processors. Our home processor is GPS, but we are open to work with any processor the program manager has an integration with.

Let us take care of

payments for you

We have at our disposal an extensive product set, which we make available to our program managers.

Enjoy powerful integrated services and a frictionless experience from one single source:

- Omnichannel acquiring – flexible solutions, efficient on-boarding, easy-to-integrate APIs – find out more about Card Acquiring here

- eWallet solutions – our white label wallets offer a seamless experience and are packed with features. find out more about eWallet here

- Payment tokenisation – allows you to bring payments to the mobile phone and help reduce fraud

- Cash loading onto cards through partners

- A range of banking services – IBAN accounts, bank transfers, FX, etc. Find out more about IBAN Accounts here

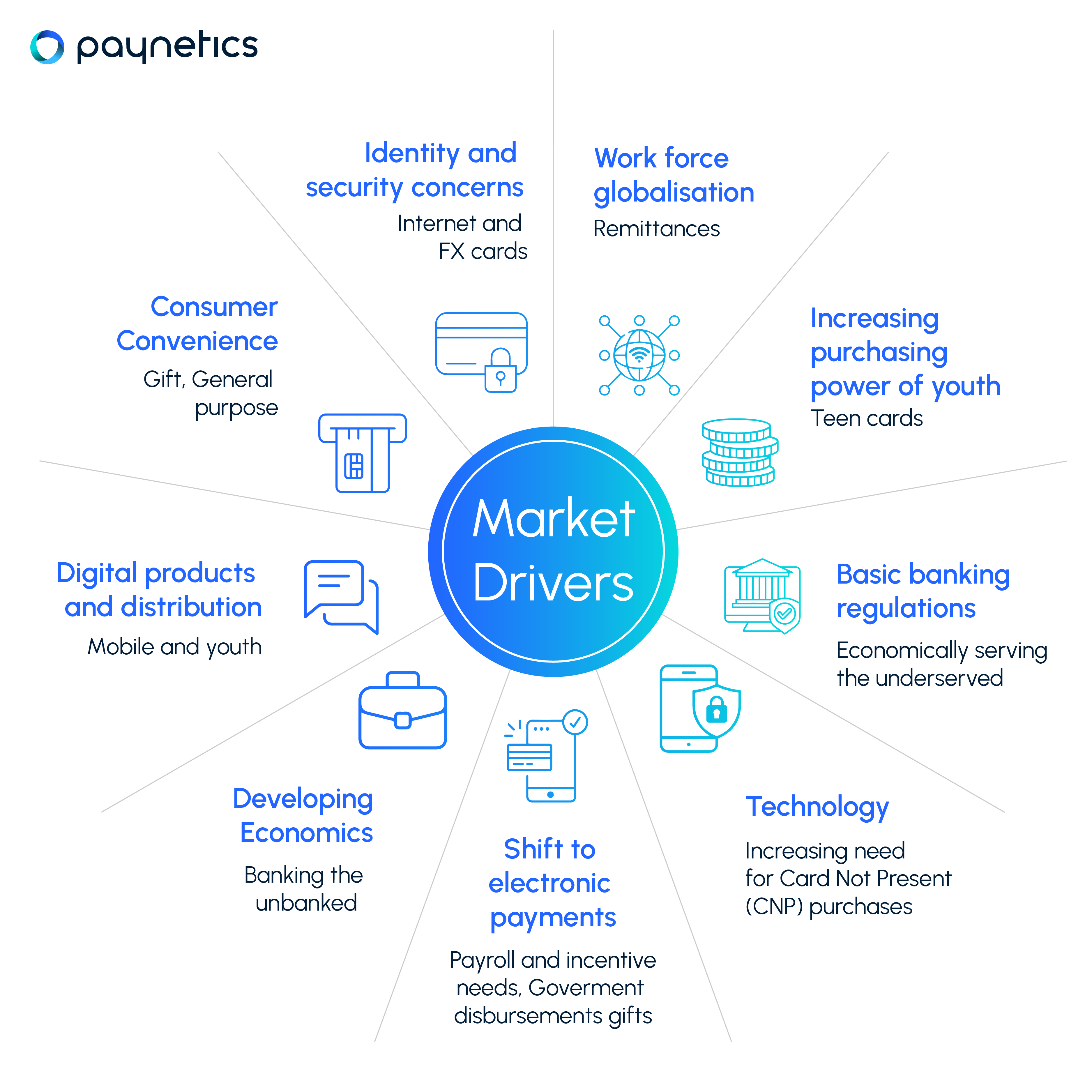

Market

Drivers

Digitalisation and globalisation are changing the market. We are here to support you as you face the challenges that these pose, and make the most out of the opportunities that they create.